What Is the Significance of Accounting in Your Business? (4 Video Links)

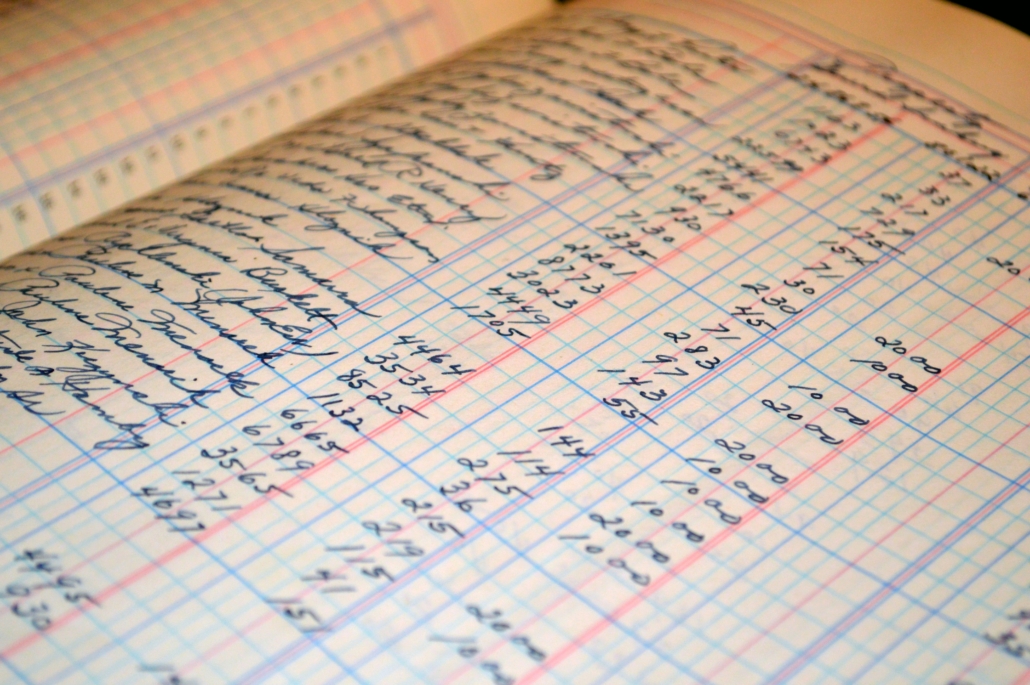

Accounting has been an aspect of every business since the earliest times. It is a crucial business function, since it helps you to examine your company’s revenue and expenditure. The significance of accounting, however, differs from one business to another. Accounting is often overlooked by small business owners, putting everything at risk.

Lack of records eventually results in extra tax payments, making tax adjustments, deals falling through, incorrect audits, and other problems. When your financial records fail to speak for you, your business will collapse. Hence, if your account management is poor, it’s high time you start taking appropriate measures. Learn more about why accounting is crucial in the sections that follow.

Consult with a CPA regarding all tax and accounting issues.

Contents

Seasonal Preparations

When you are doing the everyday operation of your business, perspective might be difficult to acquire. It might be challenging to see the company’s big picture when you are busy with sales or working late to meet a deadline. This is where accounting plays its part. It allows you to assess whether your company is moving on the right track, depending on the trends or not.

Subscribe to Accounting Accidentally on Substack. Get links to new content on accounting, personal finance, and humor/ short story topics.

For example, there are seasonal businesses that make profits only during seasons, such as HVAC. Companies dealing in HVAC make a profit during summer by selling air conditioners and make a profit during winter by selling heaters. While rest of the year, their business slows down. Similarly, if someone took the lawn-maintenance franchise opportunity, they are likely to profit during the fall and spring for fertilization and cleaning reasons.

When there’s such fluctuation in sales and profits in the same year, it becomes difficult to track the finance. It’s when accounting helps them to take measures and prepare ahead of the sluggish business. It offers an accurate picture of the revenue in the coming months through which managing cash flows become feasible.

Keeping Your Business Organized

Several groups are interested in an organization’s financial records, including investors, lenders, and employees. Specific organizations- such as non-profits- benefit from being as open about their finances as possible. Moreover, if the records are disorganized, stakeholders find it difficult to trust the company, and business reputation may be harmed. An accounting system organizes every complicated financial document, making it easier to access and distribute to appropriate parties.

Staying Within the Law

Having sound accounting systems and practices in place might help your company stay lawful. The accountants’ primary role is to follow up with the company’s legal procedures, taxation, and financial affairs. Hence, good accounting practice helps your business avoid specific penalties and tax payments.

Consult with an attorney on all legal issues.

Decision-making

Accounting gives information regarding the business’s financial position, such as liabilities and assets, profits and losses, cost and earning, etc. Competent financial data helps you to make decisions such as whether to sell your alarm accounts, recruit new staff, make charitable donations, purchases, and so forth.

Preparing You for Tax

Businesses have to file their taxes at the end of the tax year, no matter how inconvenient. With an accounting system, you will have the financial information ready for the tax season. It will be helpful if HMRC requests a financial statement from your company for tax purposes. You will be able to predict the conclusion more precisely if you keep detailed balance sheets over time.

Avoiding Audits

An audit is something no company wants to go through. Poor management invites the kinds of errors that draw the attention of the authorities. These mistakes include disorganization of a tax return, claiming too many costs, reporting too many charitable gifts, etc. A sound accounting system helps you avoid errors and reduces the chances of an audit, which can significantly help small business owners.

Budgeting

Budgeting in a business is essential for the company to grow. Business owners need accountants who can assist them in the preparation of the overall plan. This includes evaluating the cost of services and the types of company operations earning the most profits. Hence, budgeting helps in creating a company’s financial roadmap.

Ensuring No Overdue or Late Payments

An efficient accounting system makes the job of the business owner easier. It helps in keeping track of costs, invoicing, payroll, and the total budget. There are also numerous apps and software available that help to streamline the process for busy firms. Such applications and websites ensure that no errors are made while saving you a significant amount of time.

With a simple click, they may even send payment reminders or late notices to clients. A good accounting process in action hence makes the owner’s life easier. It allows for easy financial tracking and access besides avoiding any penalties. It also helps ensure there’s no outstanding payment or receipt. This, in turn, significantly increases business profits as no invoices are lost or missed.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and finance.

Good luck!

Ken Boyd