Protecting Yourself In The Event Of An Audit

It’s the event that most business owners want to avoid the most when it comes to their accounts. Even in the event that no wrongdoing is found, audits can be terribly stress inducing, not to mention time wasting. However, if you’re getting audited, you can do more than simply sit and wait. You can make sure that you’re safeguarding yourself as best as possible.

Contents

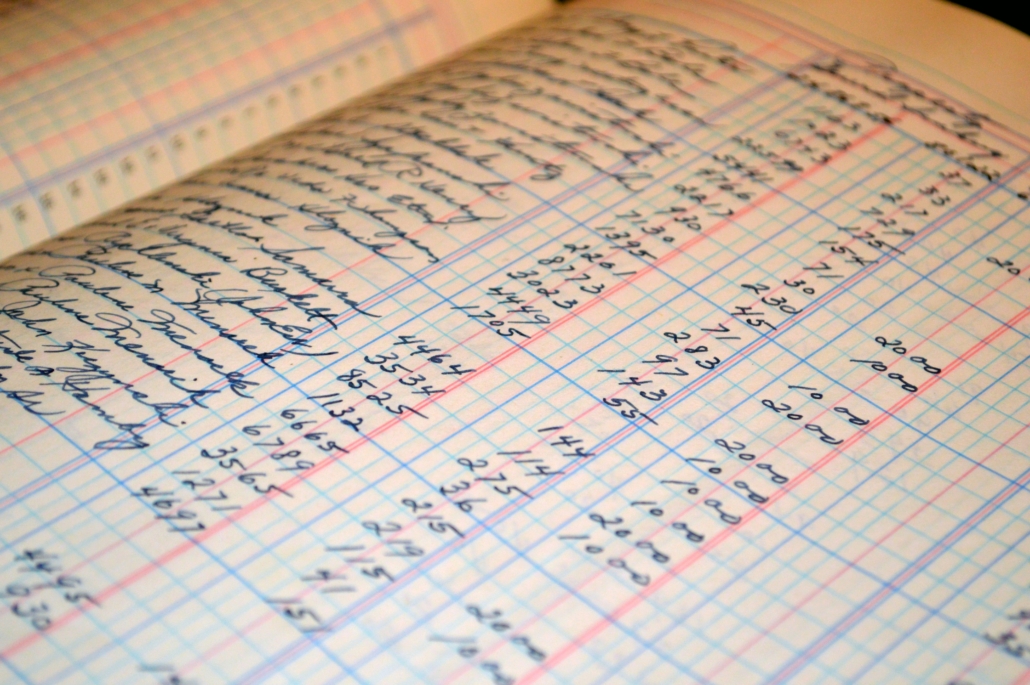

Locate and organize files

As soon as you are notified of an audit, gather your records and review them with a CPA in detail. Keeping detailed records of your finances is an essential part of managing your money properly, and now it’s more important to be able to provide those records more than ever.

Make sure you’re providing specifically what is being asked for, as any delays can work against your favor. You need to make sure you’re preparing the right documents and that you’re ready to submit them on time.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

Hire an expert to prepare tax returns

You should ensure that your taxes and tax returns are both being prepared by someone that you are able to rely on. To put it simply, you should have a chartered accountant take a look over your records to see where deductions and credits are being used.

An inexperienced tax preparer without the right training may take large-scale deductions where they shouldn’t, which is what can lead to an audit. An accountant can be with you during an in-person audit as well.

Consult with a tax attorney

In addition to a qualified tax preparer, you need to consult with a tax attorney. With the highest quality legal services, you can get advice from tax attorneys on how to handle the audit before any such accusations come. Should you be accused of an improper act, you then have the right help by your side to help you mount a defense as swiftly as possible.

Don’t speculate on tax issues

You might not be able to remember every detail about your books. However, you should be careful not to speculate where you don’t have the facts. Saying things that are not consistent with the records on hand can harm your case.

This is a good reason to make sure that your accountant speaks for you during your in-person audit.

How the audit goes will depend, in part, on whether or not the auditors can find anything wrong with your finances. But it can also depend on whether you’re able to defend yourself against charges well, too. Consult with a CPA and a tax attorney on these important issues.

Go to Accounting Accidentally for 400+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) https://www.accountingaccidentally.com/