What the Under Armour Accounting Scandal Teaches Us About Liquidity Ratios (Video Link)

Under Armour’s CEO is stepping down, and the stock price declined by over 18% on Mon, 11/4.

What happened?

The company’s third quarter earnings report was negative, but the bigger story is this:

“Department of Justice is conducting a criminal inquiry into whether Under Armour shifted sales from quarter to quarter to make the company appear healthier.”

This is a classic example of “robbing Peter to pay Paul”, and the strategy isn’t sustainable.

Contents

Why Shifting Revenue Catches Up With You

Let’s assume that Under Armour projected $50 million in revenue for the third quarter. There are two weeks left in the quarter, and the firm projects $48 million in revenue.

One way to make the revenue number is to bend the rules on revenue recognition.

Now, that’s a problem for accountants, because of the principal of consistency. Once Under Armour decides on a method to recognize revenue, they need to stick with it. If not, the financial results aren’t comparable from one period to the next.

Assume that Under Armour posts revenue when goods are shipped to the client. Late in the third quarter, they decide to bend the rules. To earn an additional $2 million, the company recognizes revenue when $2 million in orders are placed.

Placing an order is not the same as shipping an order, and there’s a higher probability that the customer may cancel the order. But it gets the third quarter revenue to $50 million.

But the firm is taking $2 million in revenue away from the fourth quarter- can they make up the $2 million and hit the 4th quarter number?

Or will they have to bend the rules again?

It catches up with you- and can make the financial results much worse in later quarters.

This is a great example to explain liquidity ratios.

If you’ve taking an intermediate accounting class, or studying for the CPA exam, you may struggle with calculating liquidity ratios.

You’re not alone.

This discussion explains these concepts using a screenshot from spreadsheets. Here’s a video link that explains the topic.

When you think of liquidity ratios, think of your checkbook.

Liquidity Ratios

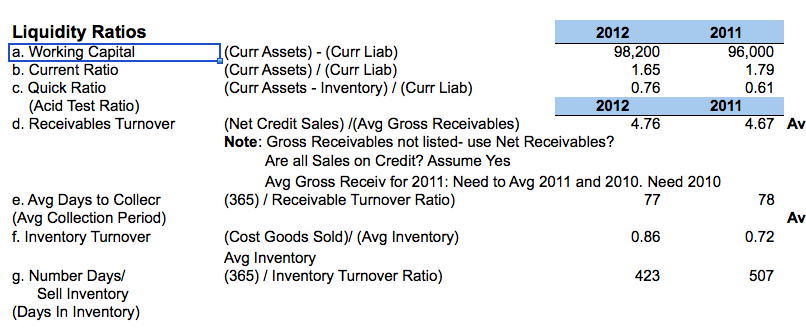

Liquidity asks the question: Can you generate enough current assets to pay all of your current liabilities? Check out the spreadsheet below:

Current assets and current liabilities

Current assets include cash, and other assets that will be converted into cash within 12 months, including accounts receivable and inventory.

Current liabilities include the accounts payable balance, and other liabilities that will be paid within 12 months. That includes the current portion (principal and interest) owed on long-term debt over the next year.

If Under Armour posts an additional $2 million in third quarter revenue, the firm will also increase accounts receivable by the same amount.

Remember: the firm is recognizing income earlier than normal. It’s unlikely that any cash has been paid, so accounts receivable is increased. Higher accounts receivable increases current assets.

Working capital, current ratio, and acid test ratio

- Working capital: Current assets less current liabilities. The goal is to have a positive working capital balance, which means you have more than enough current assets to pay current liabilities.

- Current ratio: This presents the working capital information as a ratio (current assets / current liabilities). Your goal is to have a ratio of 1.0 or higher.

- Acid test ratio: The formula subtracts inventory from current assets in the current ratio formula. The rationale is that inventory is the current asset that takes the longest time to convert into cash. So, let’s remove that balance and look at the ratio.

Posting an additional $2 million accounts receivable will make all three of these ratios look better.

Manipulating revenue has a massive impact on reported financial results

My next book, 25 Intermediate Accounting Spreadsheets (and How to Use Them) will be out in 2020. The format will include a written discussion of a spreadsheet, with spreadsheet images, and a related video.

To learn more and get sample chapters of the book, watch this video.

For live CPA exam prep and accounting classes, join Conference Room for free. Members will be notified of course dates, times, costs, and how to attend these courses.

Get your questions answered to pass the CPA exam, and to learn accounting concepts.

Go to Accounting Accidentally for 300+ blog posts and 450+ You Tube videos on accounting and finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) https://www.accountingaccidentally.com/