The Small Business Way of Managing Your Finances

The first few years of any new small business are important to its long-term success, with many lessons to be learned and challenges to overcome. Mismanaged finances and cash flow problems are the primary culprits behind business failures in the early years. Some businesses don’t keep track of their costs, fail to plan or keep a close eye on their cash flow. Others have the right idea by looking into merchant account services, like those you can find at https://www.easypaydirect.com/merchant-accounts/high-risk-merchant-accounts/, to help keep their business in competition with others by keeping good track of costs and transactions.

Whether you offer piano lessons for students in Las Vegas or run a small bakery in NYC, taking practical steps can help you control your spending and grow your business, no matter its location, without the financial risks.

The Importance of Managing Your Business’s Finances

By understanding the basic skills needed to run a small business – like drafting financial statements, applying for a loan or doing accounting tasks – business owners can create a stable financial future without worrying about big failures. Apart from education, the organization of finances is a major component of stable money management.

Join Conference Room the online community for accounting, personal finance, and entrepreneurship. Blog posts, videos, live chat.

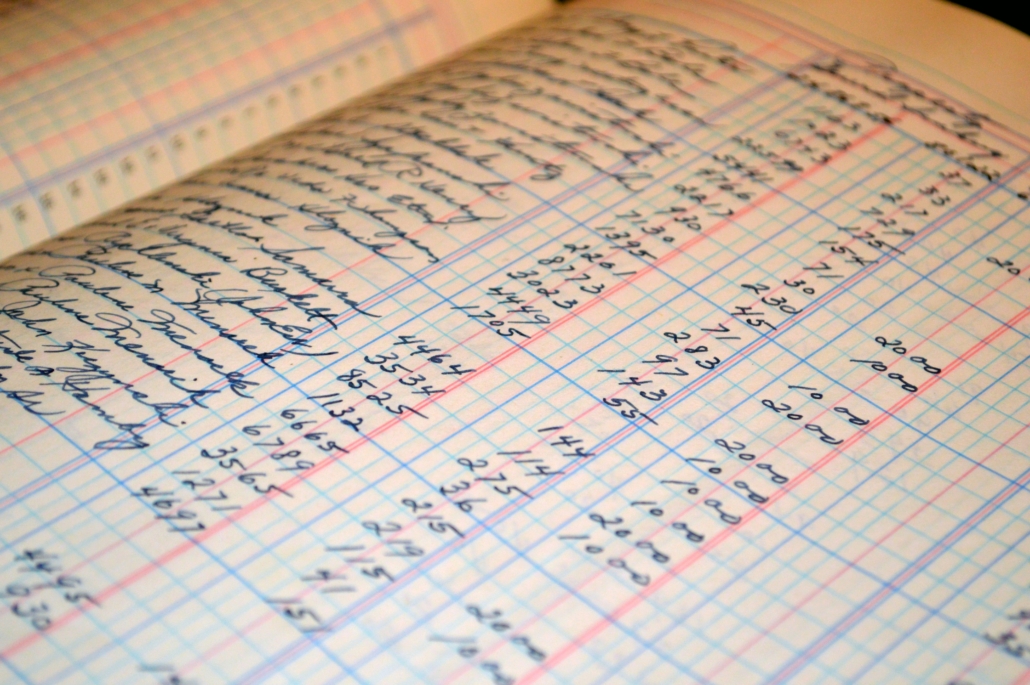

There’s nothing more costly, risky or downright terrifying than showing up at your accountant’s office at the end of the year with endless bills and receipts. Managing your business finances creates a stable financial future that secures your small business’s growth and success.

Tips for Managing Your Small Business Finances

Keep the following things in mind so you can stay on top of your finances:

Hire an Accountant

Find an accountant to act as your trusted financial advisor. Hiring a professional, however, can be expensive. Is a cheap accountant worth it? WizzAccounting offers you a faster and more affordable accounting service than a traditional high street accountant. These UK accountants are available to you via chat, phone, and email. Contact them for affordable help.

Pay Yourself

If you are running a small business, putting everything into daily operations may seem easy. After all, the additional capital goes a long way in helping your business thrive. But you shouldn’t overlook your role in the business; always compensate your company accordingly. Don’t be part of the group of small business owners who neglect to pay themselves.

Although it’s important to get the business running and pay everyone else, you need to pay yourself. You’re part of the business. You need to pay yourself as much as you pay the others.

Use Financial Planning and Forecasting

Develop a financial framework or plan to keep track of the money coming into and out of the business. For instance, one financial model your business may follow can be:

- 20 percent of the revenue on the future, for developing new services and products.

- 30 percent of the revenue set aside for building the business. This includes recruiting costs or expansion of equipment.

- 50 percent of revenue on expenses. This includes supplies or payroll.

Different business plans work for different small businesses. Talk to your accountant to determine the best business model for you.

But circumstances can also change. When they do, your plan must change with it. Forecast your business’s possible financial run for the half of the year. Be realistic in estimating the amount your business will gain or spend. Input these numbers in your financial plan and see if the model still works for your business. If not, change your plan.

Invest in Growth

Set aside a portion of your profits and look for business opportunities. This allows you to move toward a healthier financial direction. As a small business owner, you should always keep an eye on the future.

Small businesses that want to grow, attract the best clients and employees and innovate should demonstrate their willingness to invest in the future. Clients will appreciate the continuous improvement of products and services. Employees will appreciate your investment in their growth. And ultimately, you will create more value for your business than spending all of your profits on personal gains.

Chart Your Cash Flow

Quality accounting software creates charts of outflows (accounts payable) and inflows (sales of services or goods) for your business. It can also change the period and other variables so you can understand your current financial situation. If you look at these charts regularly, you’ll get a better idea of the amount of money that goes into and out of your business.

As a rule of thumb, your inflows must be greater than the outflows to make a profit. The size difference between the two, however, matters more. This gap will vary over time since few businesses make profits consistently. Some weeks or months will be good; others, not so much. Looking at these charts can help you follow the patterns of your financial values.

The Bottom Line: Put Financial Management at the Heart of Your Business

Managing your cash flow and finances should never be an afterthought. Instead, consider it a fundamental aspect of your business strategy. Even if you’re a small business owner, you must understand the numbers that drive business growth.

Remember: only you and good accounting can steer your business in the right direction.

Thanks!

Ken Boyd

Go to Accounting Accidentally for 300+ blog posts and 450+ You Tube videos on accounting and finance:

https://www.accountingaccidentally.com/