Financial Considerations When Starting Up A New Business

Starting up a business is a very exciting time. It can be easy to get swept up with the making the ideas, generating a website and social media presence, creating logos and branding as well as finalizing your product or service.

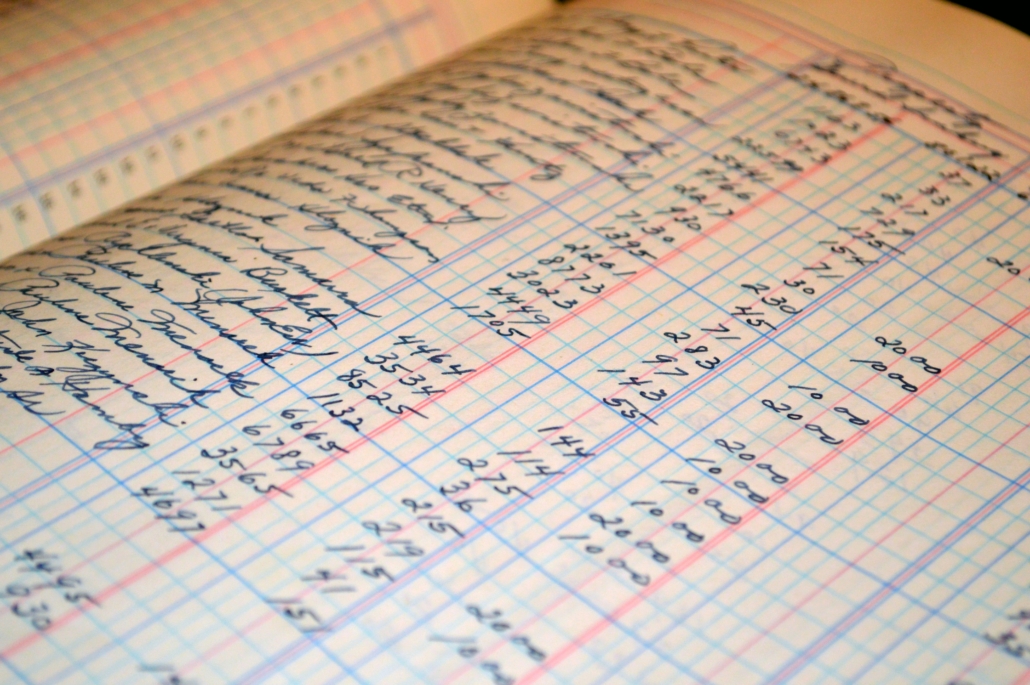

Although, along with those elements it is also important to consider your financial needs, along with considering as and when to appoint an accountant to help you with your businesses financial needs.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

Contents

Managing Investments

Depending on the business you are setting up, you may need initial financial support to allow you to get this business off the ground. It is really important that if you are realistic with the expected expenditure you will have and that you have a well considered business plan in place to demonstrate your business offers a good investment concept.

Understanding How You Will Financial Support Yourself

Starting any business costs money. It is vital that you have considered how this will be funded. Also, it takes a while for a business to take off and profits to show. Again, it is important that while you’re in the initial stages that you’ve considered how you will live and continue to support yourself and the business.

As noted above, you may look at getting investments. You may have savings or alternatively you may continue to work elsewhere while setting this business venture up on the side until enough profit is being made to support you financially.

It is really important that you consider the financial aspect if you want your business to work. You need to be realistic with your outgoings and how long you have the financial capacity to support this, along with realistic timescales as to when you expect to see profits.

Keeping Personal And Business Finances Separate

Although it may not seem too important in comparison to other tasks you have to complete when starting up, it is worth setting up a separate account for your business.

By doing that, you will be able to manage separate business expenditures and when it comes to completing your taxes you’ll know what can be deducted from your gross profit. If you have personal and business banking merged it can make this task a lot harder to know which bill links to either work or pleasure.

Tax And Legal Issues

You want to make sure that you are registering your business correctly and that then you are completing your taxes correctly each year. It is worth making sure this is set up properly as once done, it will free up more time for you in the long run to focus on your business. Ask an accountant and an attorney for help with these issues.

Working with Credit

Along with the considerations for start up, it is also worth considering and having a plan in place for your businesses future. With that in mind it is worth considering monetizing bank instruments and what lines of credit will be available to you and your business in the future if required.

Go to Accounting Accidentally for 400+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) https://www.accountingaccidentally.com/