Startup Business? Don’t Make These Catastrophic Financial Mistakes!

Each year, thousands of Americans ignite the spark of their entrepreneurial spirit and start new businesses. They do so with the aspiration of building a brand and working towards some sense of financial freedom.

The sad truth is that some of those people end up making mistakes during their crucial startup stages. As a result, they sometimes end up in deep financial trouble. If you’re starting a business, you need to avoid making the following catastrophic financial mistakes:

Contents

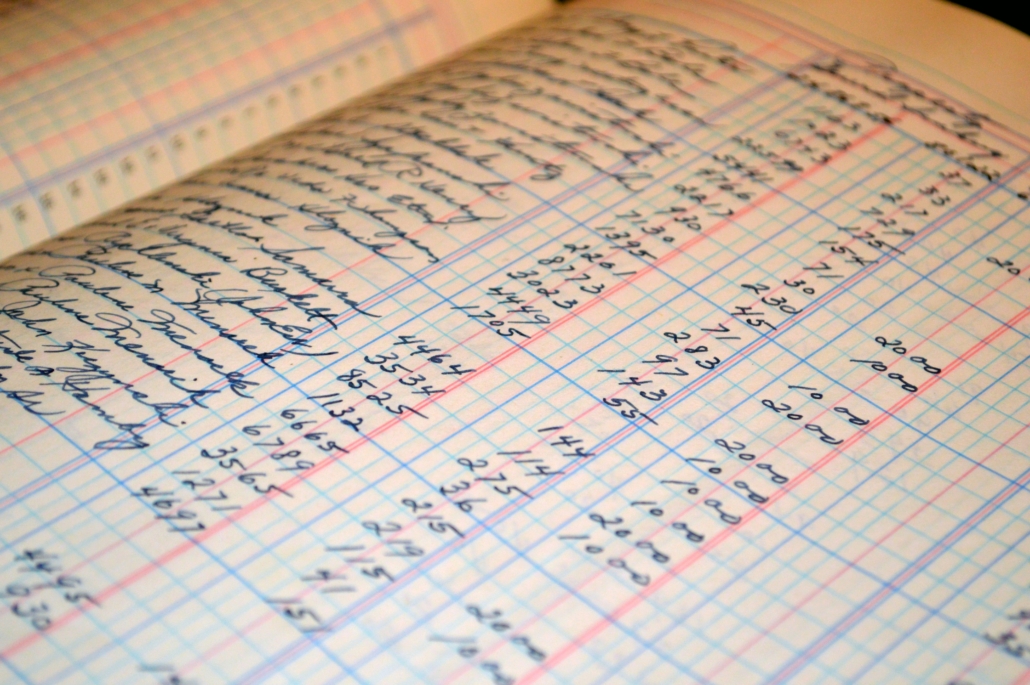

Not Getting an Accountant

It doesn’t matter if you’re a sole proprietor, in a partnership with some other people, or you’ve set up an incorporated company. If you want to make sure your tax affairs are in order and you’re not doing anything wrong, you need an accountant, preferably a CPA.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

Otherwise, you could end up falling afoul of the IRS and needing tax resolution services to sort out your taxation problems. Another fact to keep in mind is that an accountant can also help you save money on your tax returns.

Accountants are generally affordable to virtually all startup businesses, and the relatively low cost of their services for startups will be worth the support and advice you receive from them.

Not Keeping Your Finances Separate

Irrespective of how you set up your new business, one thing is vitally important: you should always keep your business and personal finances separate. If you blur the lines between the two, it can be quite challenging to differentiate between the transactions.

It can also raise some eyebrows at the IRS, because they might suspect that you’re filing incorrect tax returns. Whenever you start a new business, always open a separate business checking account.

That way, you can use it for all business expenses, and it shows anyone that looks at your bank statements how much money you and your business partners put into your startup.

Going Crazy With Spending

The aim of building a successful business is to keep your expenses low to maximize your profit. It can be frustrating when you want to buy all kinds of cool and useful items for your business, but you have to be strict with your spending.

Otherwise, you might find that you have no money to operate it, and you’ll either have to invest more of your money, or borrow some from a financial institution. Of course, there are some ways you can get what you need without making yourself bankrupt in the process.

For example, you could consider used or refurbished items instead of brand new ones. Or, you might start building a savings fund for certain machinery or equipment you need for your business to avoid borrowing the money for it.

One of the main reasons for many a startup’s downfall is through over-enthusiastic spending.

Final Thoughts

The above is by no means an exhaustive list of reasons why some startup businesses end up in financial ruin. But, it’s a list of the most common ones. If you’re starting a new business, make sure you avoid those financial problems.

Consult with an accountant and an attorney when you start your business.

Go to Accounting Accidentally for 400+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) https://www.accountingaccidentally.com/