Tips To Avoid Going Under As A Business

As a business, there can be a lot of jobs riding on the success of the enterprise, and the firms’ ability to keep its head financially above the water. There can be many obstacles and scenarios where this is tested, and it’s important that you do everything you can do to stop your business from suffering too badly. However, there have and will be plenty of businesses that collapse. Here are some tips to avoid going under as a business.

Contents

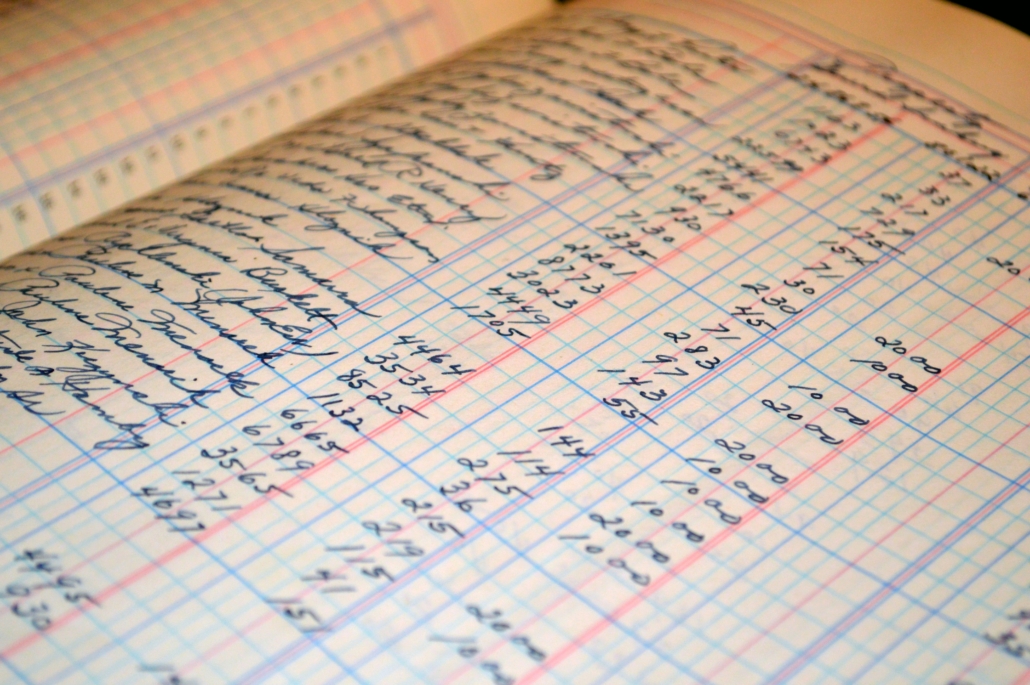

Have A Good Accountant/Finance Team

The secret to good finances is having the right people in the role. When it comes to your books, it’s worth getting a good accountant, or making sure you have a finance team in place to handle it all. For small businesses or those with perhaps a handful of staff, you might have to take on the responsibility yourself as a bookkeeper.

However, it’s worth outsourcing this role as soon as the work starts to pick up on your end. The last thing any business owner wants to do is to take on things that will slow them down and perhaps spread the attention to detail a little too thin. It’s something you don’t want to risk when it comes to handling your accounts, as you don’t want to end up falling behind.

Be Wary Of Risks

There are always going to risks in business, some are worth taking, and some are worth avoiding. Risks are something that you want to trust your gut with, so if it doesn’t feel right, it’s best not to go through with it.

Getting the information about bankruptcy should certainly help you question more decisions you make in the future and how you pick and choose the opportunities that have risk involved. Never invest in something that, if it failed, you couldn’t get yourself out of without going under or risking jobs.

Avoid Getting Into Too Much Debt

Debt isn’t something you want to be building up to such a level that it’s hard to pay off. A company credit card will probably be needed eventually, but it’s important to always pay off the money straight away when it’s due, instead of spreading the costs.

Debt can muddle up how much you actually have available to spend, and it’s very easy to get yourself into a serious issue when it comes to spending more than you have. Try to avoid getting into too much debt where you can.

Make Sure You’re Getting Paid On Time

Getting paid on time is definitely important, and so when it comes to your clients, make sure you’re chasing payments. Even if they’re a day late, it could set you back in what you need to spend money on. You always want to have money coming in before you have money going out, not the other way around.

Those few mistakes could end up costing you a business, so make sure you’re following these tips to avoid it. It’s not worth losing your business it!

Find great subscriber-only accounting video and blog content on my Patreon page. Get your questions answered to pass the CPA exam, and to learn accounting concepts.

Go to Accounting Accidentally for 300+ blog posts and 450+ You Tube videos on accounting and finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) https://www.accountingaccidentally.com/