What Pier 1’s Bankruptcy Teaches Us About Return on Assets (blog post, graphics)

What’s the rate of return?

It’s a common investor question.

When you’re investing in stocks, bonds, or mutual funds, it’s helpful to know the investment’s historic rate of return. You compare the investment risks to the rate of return, and use that analysis to make a decision about investing.

A business owner should consider the rate of return on company assets. If you use assets productively, your firm will be more profitable over time.

Pier 1 Imports struggled with earning a return on assets- and it’s put them out of business.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

Contents

What Happened

As the Wall Street Journal wrote in February of 2020:

“Pier 1 Imports Inc. the funky furniture retailer that started out selling bean bag chairs and love beads to hippies and later grew into a home-furnishings giant with more than 1,000 stores, filed for bankruptcy Monday, a victim of changing consumer tastes and an unforgiving retail environment.

It plans to close up to 450 stores and cut costs to slow down its cash burn.”

Ok, the company was burning cash- but why was the rate of cash burn so high?

“… the company’s struggles can be traced to increasing competition from online players, mass merchants and off-price retailers, such as Wayfair Inc., TJX Cos .’s HomeGoods, Bed Bath & Beyond Inc. s’ Cost Plus World Market and Amazon.com Inc.

The company was late to embrace e-commerce and was forced to build an online business from virtually nothing. Along the way, it had to absorb the costs of building distribution centers and other infrastructure, while also adjusting to the tighter margins from online sales.”

Earning a Return

In my Accounting All-In-One For Dummies book, I define several metrics for measuring rates of return:

- Return on assets: (Net income) / (total assets)

- Return on equity: (Net income) / (total stockholders equity)

- Return on investment: (Net income) / (cost of investment)

Each of these rates of return is considered to determine company profitability.

To explain the accounting issues at Pier 1, consider this simple example:

Julie owns of Sideline Sports, a sporting goods manufacturer. On January 1st, she decides to raise money from outside investors for the first time, in order to start selling her merchandise using an e-commerce site.

Sideline issues $300,000 in equity, and uses the proceeds for these items:

- Hardware, software, other tech purchases: $48,000

- Training for employees: $2,000

- Consulting fees to programmers: $250,000

The e-commerce business generates a $40,000 profit in year one.

Here are the rates of return for year one- just for the e-commerce portion of Julie’s business.

Return on assets

($40,000 net income) / ($48,000 total assets) = 83%

Now, that return is misleading, because the e-commerce site required $300,000 in spending, but only $48,000 was used to invest in assets.

Some businesses, such as banks, require a big investment in assets (bank locations, operations departments, hardware) to operate. Professional service companies, such as lawyers and accountants, don’t require a big asset investment. Service companies sell knowledge, and they don’t need a large asset base.

Return on equity

($40,000 net income) / ($300,000 total stockholders equity) = 13%

This ratio is more useful. Sideline earned a 13% return on the equity invested.

Return on investment

($40,000 net income) / ($300,000 cost of investment) = 13%

The $300,000 equity raised was invested in the e-commerce business, so the return on investment ratio is the same as the return on equity ratio.

It’s all about how much profit you can squeeze out of the assets you own, the equity you raise, and the investments you make.

Squeezing out Profits

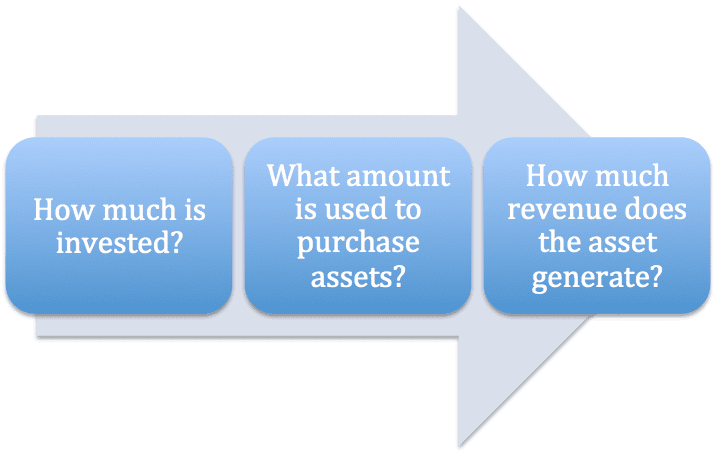

Think about a plumber. He drives a $20,000 truck that carries $10,000 in equipment to do residential plumbing- a $30,000 investment in assets. If the plumber generates $60,000 in annual income, that’s a 200% return on assets.

Why is the return so high?

The plumber’s primary role is to provide a service. He can use the truck and the equipment over and over again. So, think about assets this way:

Which brings us back to Pier 1’s issues.

Pier 1 had to make a huge investment in e-commerce. At the same time, online competition was forcing down profits on e-commerce business.

The result?

The shrinking profits could never generate a reasonable return on the e-commerce investment.

The Lesson

Before you make an investment, ask yourself: Are my assumptions about profits realistic? Are industry changes or competition reducing the future profits on the potential investment?

Food for thought.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) https://www.accountingaccidentally.com/

Image: Pier by Hernan Pinera, CC By-SA 2.0