What a Pentagon Scandal Teaches Us About Accounting Changes (Blog Post, Graphics)

Accounting adjustments can be a red flag for an auditor.

If a company has an experienced accounting staff and strong internal controls, they’re going to get most things right. Each accounting entry is supported by sources documents, such as invoices, receipts, and purchase orders. Accounts are reconciled in a timely manner, and the financial statements are accurate.

The bottom line?

Company stakeholders- including investors, creditors, vendors, and regulations- have confidence in the financial statements.

Several types of adjustments are posted during a typical month and year.

Contents

Four Common Adjustments

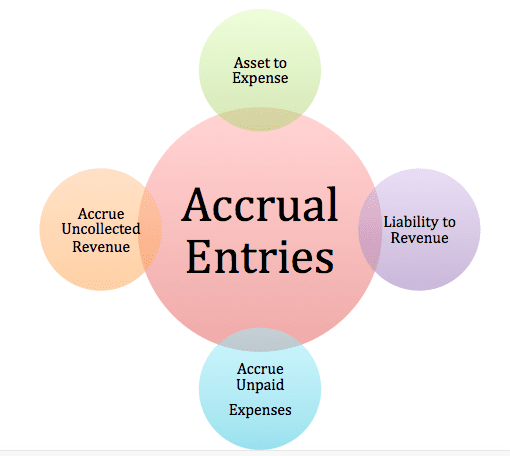

Nearly all businesses use accrual accounting, which matches revenue earned with the expenses incurred to produce the revenue. Accrual accounting does not post income or expenses based on cash inflows and outflows, and it’s a more accurate way to calculate business profit.

These are common adjustments made to comply with the accrual basis of accounting:

#1- Converting an asset into an expense

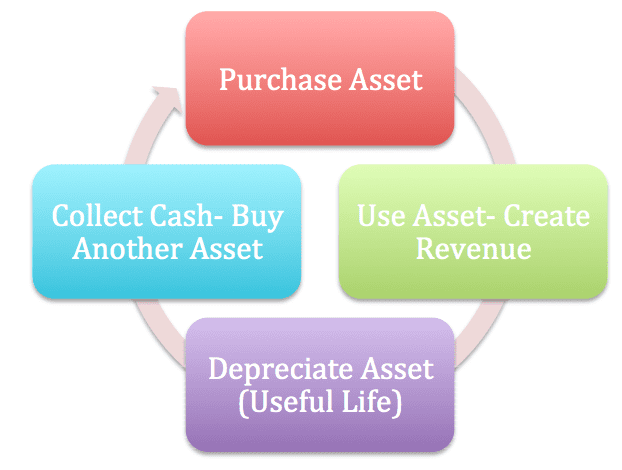

Assets are purchased to generate revenue.

When you use assets in your business, you convert the asset balance into an expense over time. Each year the plumber uses his truck, he recognizes depreciation expense and accumulated deprecation for the truck. The book value (true value) of the truck is (original cost – accumulated depreciation).

#2- Converting liabilities to revenue

If a customer pays a deposit, the balance cannot be posted to revenue until you deliver a product or service. When the deposit is received, you debit cash and post a credit to customer deposits, a liability account.

Once the product or service is delivered, you debit (reduce) customer deposits and credit (increase) revenue.

#3- Accruing unpaid expenses

If you owe employees $3,000 in payroll at the end of December, you post an accrual to recognize the expense in December. When you run payroll in early January, you remove the accrual. This approach posts the payroll expense in the period when the employee work was performed (December).

#4- Accruing uncollected revenue

You can also post an accrual for revenue.

Say that you’re owed $50 in interest on a certificate of deposit, but the bank has not paid the interest as of December 31st. You would debit (increase) accounts receivable and credit (increase) interest income for $50 on 12/31.

When the interest posts to your bank in January, you increase cash and reduce (credit) accounts receivable.

Accrual entries are day-to-day, normal accounting transactions.

If accounting adjustments are required after the period ends, that’s a problem. If you don’t make that $3,000 payroll accrual on 12/31, for example, your accounting records are incorrect.

So, I about fell out of my chair when I read about a recent Pentagon audit.

What Happened

MSN reported in 2020 that: “There were 546,433 adjustments in fiscal 2017 and 562,568 in 2018, according to figures provided by Representative Jackie Speier, who asked the Government Accountability Office to investigate. The watchdog agency will release a report on the subject Wednesday after reviewing more than 200,000 fourth-quarter 2018 adjustments totaling $15 trillion.”

I’m sorry- what?!

“The combined errors, shorthand, and sloppy record-keeping by DoD accountants do add up to a number nearly 1.5 times the size of the U.S. economy”, according to Representative Speier.

Image if the Pentagon was for-profit entity?

No stakeholders would have any confidence in the financial statements.

And why should they?

So this issue reveals some huge weaknesses in internal controls

Internal Control Issues

Think about your own business, and whether or not these issues impact your firm:

Source documents

Every accounting entry must be supported by source documents.

- Sales are supported by an invoice and a product shipment to a customer.

- No purchase happens, unless a purchase order is completed and properly approved.

- When goods are received, you must confirm that the goods you received match the items of the purchase order.

Don’t fall behind

Have you reconciled using last month’s bank statement yet?

If you haven’t, you may be creating a real problem.

The cash account is typically produces more transactions than any other account, which increases the risk or error- or even fraud. The longer you put off reconciling the bank account, the harder it will be to uncover errors.

Don’t fall behind in accounting- it just makes life harder down the road.

Consistent use of accounting principles

Accountants like apples-to-apples comparisons.

Consistency allows stakeholders to identify trends in the financial statements, and to make comparisons. The principle of consistency states that you should stick with the same accounting methods each month and year. If you decide to change, you need a good reason.

Think about revenue recognition. Your policy is to post revenue when a customer order is shipped, and you’ve had that policy for years.

What if, in December of the year, you decide to start posting revenue when orders are placed? That’s a problem, because you can’t compare December’s results (new policy) with November activity (old policy).

In fact, a change in accounting principle can be a red flag that management is trying to manipulate company financial results to look better than they actually are. Fortunately, accounting standards require firms to disclose the financial impact of both the old and the new method.

So what have we learned?

The Lesson

Every business posts adjusting entries to comply with the accrual method of accounting, and that’s normal. Adjustments required for a prior period- including those identified by an auditor- are an indication of poor internal controls.

For great content on accounting, personal finance, and entrepreneurship, join Conference Room for free.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) https://www.accountingaccidentally.com/

Image: muffinmax71xx