Accounting for Deferred Taxes (2 Video Links)

If you’ve taking an intermediate accounting class, or studying for the CPA exam, you may struggle with accounting for deferred tax assets and liabilities.

You’re not alone.

This discussion explains these concepts using screenshots from spreadsheets. Links to the You Tube videos that explain the topics are here and here.

Contents

Book income vs. taxable income

Deferred tax entries must be posted, because of the difference between income for book (accounting) purposes and income posted on the tax return.

The differences may be permanent or temporary, and temporary differences for depreciation expense are the most frequently tested.

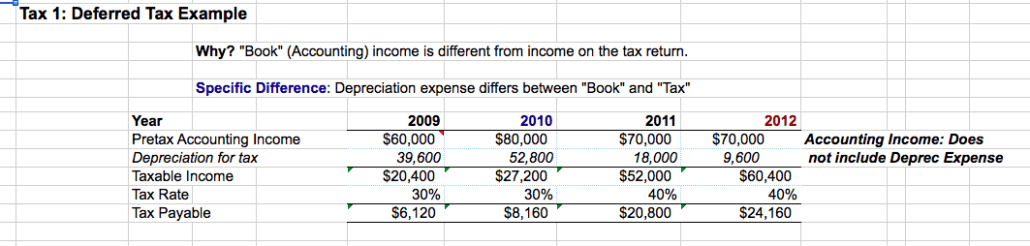

Temporary differences: Depreciation expense

This example assumes that pretax accounting income does not include depreciation expense, which is why it’s subtracted as “Depreciation for tax” on line 2 below.

The rest of the chart should make logical sense. Let’s use the year 2009 as an example. Depreciation is subtracted to arrive at taxable income ($20,400), and income is tax at a 30% rate. The tax payable is $6,120. You’ll see taxes payable for 2009 and 2012 in a journal entry at the bottom of the article.

Now, you’ll see that the tax depreciation is higher in the early years ($39,600 in ’09), and lower in the later years ($9,600 in ’12). This is an accelerated method of depreciation for tax purposes.

Book depreciation expense is different.

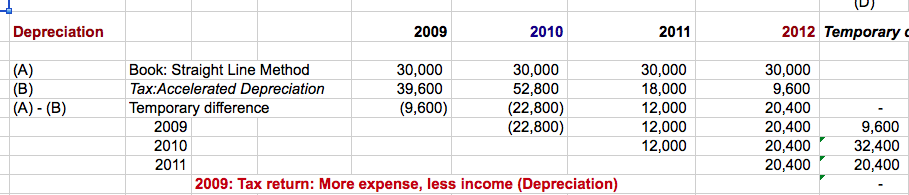

Differences in depreciation expense

This chart explains the differences between book and tax depreciation expense:

For starters, it’s important to realize that total depreciation expense is the same for both book and tax. Both methods recognize $120,000 in total depreciation expense, the difference is in the timing of the expense.

Book income uses the straight-line method, which generates $30,000 in depreciation a year for 4 years. The company uses an accelerated method for taxes.

Check out 2009:

Tax depreciation is $9,600 greater than book depreciation expense. This temporary difference creates a deferred tax liability.

Why?

As I point out in red, the business has more depreciation expense and less income on the 2009 tax return. Makes sense, because the tax depreciation expense is higher than book.

The firm posts a deferred tax liability, because the tax return will report lower deprecation expense and more income in future years.

More income, less expense means a higher tax bill down the road.

You can confirm this concept by looking at the later year.

In 2011 and 2012, book depreciation expense is higher than the tax expense. Less depreciation expense means a higher tax bill in later years.

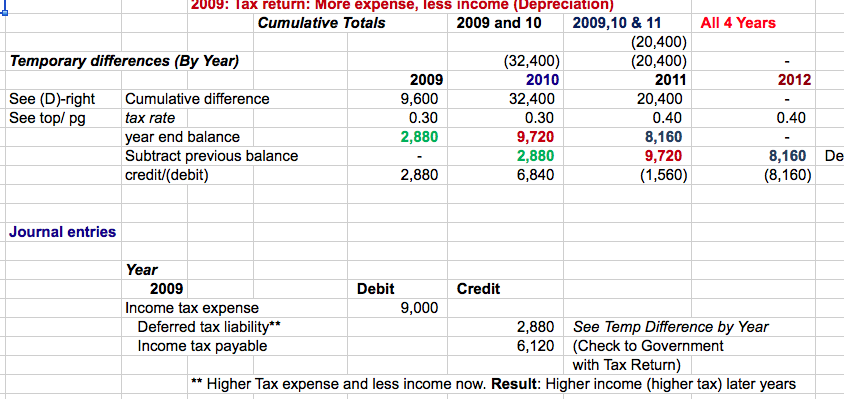

Journal entry for tax expense

The last step in this discussion is to understand the tax journal entries. Here’s a summary:

In 2009, you see the $9,600 temporary difference as the cumulative difference. As you move across the line from left to right, you see the cumulative impact of all years.

The deferred tax liability is ($9,000 temporary difference X 30% tax rate), or $2,880 (in green).

Ok, slide down the journal entry.

The 2009 income tax expense ($9,000) has two components:

- $6,120, which is the taxes payable calculation in the screenshot at the top.

- $2,880 deferred tax liability

$6,120 is the check amount your write to the IRS.

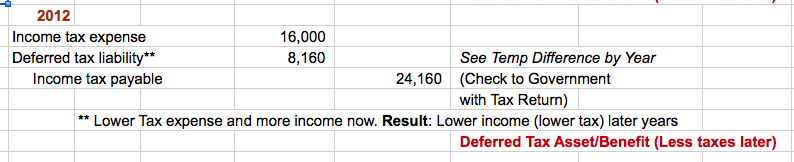

Finally, let’s review the 2012 journal entry for taxes:

The 2012 income tax expense ($16,000) has two components:

- $24,160, which is the 2012 taxes payable calculation in the screenshot at the top.

- $8,160 deferred tax asset, which lowers the tax expense to $16,000

$24,160 is the check amount your write to the IRS. The tax expense is lower than the tax payable, because of the deferred tax asset.

My next book, 25 Intermediate Accounting Spreadsheets (and How to Use Them) will be out in January of 2020. The format will include a written discussion of a spreadsheet, with spreadsheet images, and a related video.

To learn more and get sample chapters of the book, watch this video.

For live CPA exam prep and accounting classes, join Conference Room for free. Members will be notified of course dates, times, costs, and how to attend these courses.

Get your questions answered to pass the CPA exam, and to learn accounting concepts.

Go to Accounting Accidentally for 300+ blog posts and 450+ You Tube videos on accounting and finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) https://www.accountingaccidentally.com/

Image: Andrew Neele