Computing Weighted Average Shares Outstanding (10 Video Links)

The weighted average shares outstanding calculation is the number of common stock shares outstanding, adjusted for stock splits, stock dividends and other factors. To understand the weighted average shares outstanding example below, you need to review diluted weighted average shares outstanding.

The number of shares outstanding formula also adjusts for the number of months a particular number of shares is outstanding. The excel screenshots will help you understand weighted average shares outstanding basic and diluted.

This discussion explains these concepts using screenshots from spreadsheets. Links to the You Tube videos that explain the topics are here and here.

If you’re calculating average common shares outstanding, start with earnings per share (EPS).

23 Spreadsheets That Explain the Toughest Accounting Topics: Get them here.

Contents

Understanding the Earnings Per Share Formula

Earnings per share (EPS) reports the dollar amount of earnings generated for each share of common stock outstanding. EPS is a frequently used metric to determine the value of a company’s stock.

Now, there are a number of variations on the formula, but we’ll stick with the most basic version:

(Earnings available to common stock shareholders) / (weighted average shares outstanding)

Some earnings may not be available to common shareholders. If your firm has preferred stock outstanding, you may have to pay dividends to preferred shareholders before earnings are available to common stock owners.

Say, for example, that total earnings are $1.2 million, and that $200,000 must be allocated to preferred stock dividends. Also assume that the weighted average common shares outstanding total 100,000 shares.

EPS for common stock is ($1 million earnings) / (100,000 shares), or $10 per share.

Several types of securities can be converted into common stock, which impacts the EPS formula.

Types of Dilutive Securities

Financial analysts often use dilutive earnings per share to assess company value, and most analysts use weighted average shares outstanding diluted.

Dilutive EPS assume that any security that can be converted into common stock is converted. To use dilutive EPS, the weighted average shares outstanding calculator must account for securities that are dilutive:

Now that you know about EPS, let’s calculate weighted average shares of stock outstanding.

Join Conference Room: More content on accounting, personal finance, and humor/ short story topics. Video, blog posts.

Setting Up the Weighted Average Shares Outstanding Formula

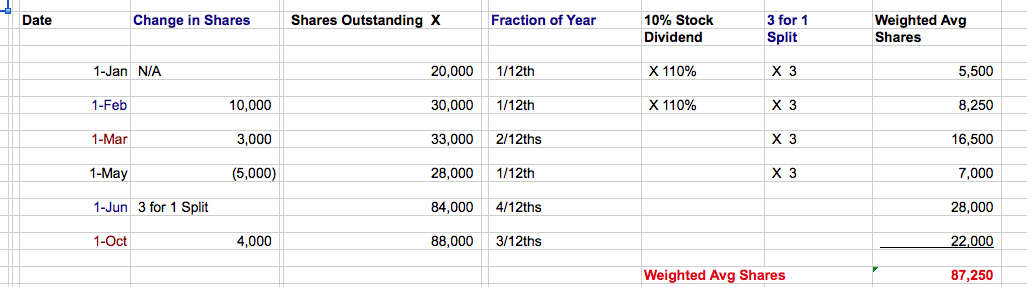

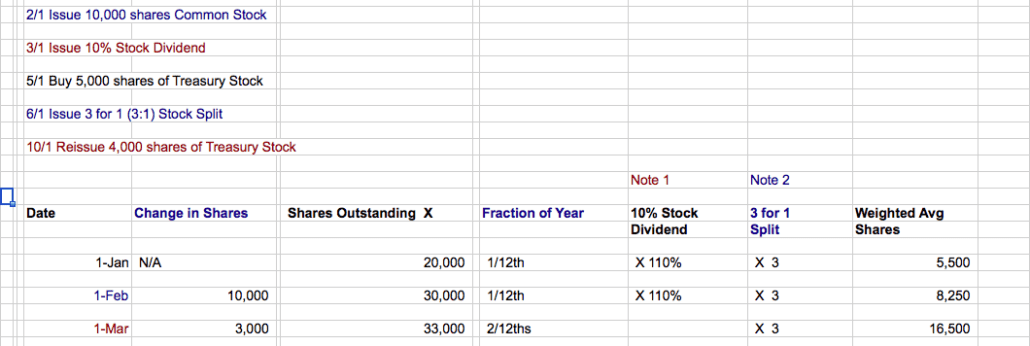

When you calculate the average outstanding shares, use the format in this spreadsheet:

This format helps you solve the problem in a document that deals with each variable.

- Change in Shares column: Lists the increase or decrease in shares, based on a specific event.

- Shares outstanding: Total shares held by the public, as of a specific date.

- Fraction of a year: Here’s the tough part: Each shares outstanding total is held for a portion of the year. This data is needed, in order to adjust the share total to compute the weighted average.

Let’s look at the share changes in detail:

On January 1st, the company starts with 20,000 shares. On February 1st, the firm issues 10,000 more shares, and the share outstanding total is increased to 30,000.

On March 1st, the business issues a 10% stock dividend. For every 100 shares previously outstanding, there are now 110 shares.

The 30,000 shares are multiplied by 110%, and the new total of shares is 33,000. Note also in the “10% Stock Dividend” column that prior period share totals are also multiplied by 110%.

Keep working your way down the spreadsheet:

On May 1st, the company buys 5,000 shares of stock from the public, and posts them to the Treasury stock account. Shares outstanding decline to 28,000.

The firm issues a 3 for 1 (or 3:1) stock split on June 1st. Every 100 shares now becomes 300. The 28,000 shares outstanding is adjusted to 84,000 on June 1st. The “3 for 1 Split” column adjusts shares in the earlier periods for the stock split.

The Outstanding Shares Calculation

To compute the weighted average shares outstanding, multiply across for each period.

The 20,000 shares are outstanding from Jan 1st to Feb 1st, or 1/12th of the year. The formula for weighted average shares is:

(20,000 shares) X (1/12th of year) X (1.1 stock dividend) X (3 stock split) = 5,500 shares

On October 1st, the company takes 4,000 out of treasury stock and reissues them to the public. The new share total is 88,000, and the shares are outstanding from 10/1 to 12/31 (3 months).

The formula for weighted average shares outstanding is:

(88,000 shares) X (3/12ths of year) = 22,000

In this case, the shares are already adjusted for the 10% stock dividend and the 3:1 stock split earlier in the year.

How Weighted Average Shares Outstanding Is Used

The weighted average shares of stock outstanding total 87,250. This total is used to calculate earnings per share.

Go to Accounting Accidentally for 600+ blog posts and 450+ You Tube videos on accounting and finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net