What the Warby Parker Stores Teach Us About Capital Budgeting

Warby Parker, the eyewear company, is “aggressively expanding its bricks-and-mortar footprint and says it is on track to open 35 new stores this year”, according to the Wall Street Journal.

Now, that may seem strange after the pandemic, but the business has noticed a consumer trend. Many shoppers want a hybrid buying experience. Customers look at frames online, and prefer to try on glasses at a physical store location.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

The timing of Warby Parker’s expansion is good, because landlords are offering attractive terms to get tenants after the pandemic.

Evaluating a capital investment

Opening new stores requires a large investment, and the company must assess how long it takes the firm to generate enough incoming cash to recover the cost of the investment. This is a capital budgeting decision, and the business must consider the cash inflows and outflows related to each store location.

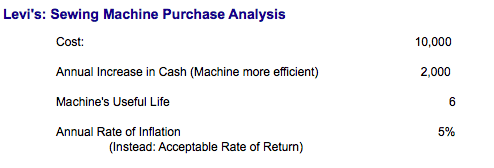

Here’s a simple example: assume that Levi’s, the jean manufacturer, has to buy a new sewing machine for jean production:

Levi’s spends $10,000, and expects the machine to increase productivity. The company will earn $2,000 more per year, due to the increased efficiency in production. Useful life for the machine is six years, and Levi’s assumes 5% as an acceptable rate of return on the investment.

Using new present value

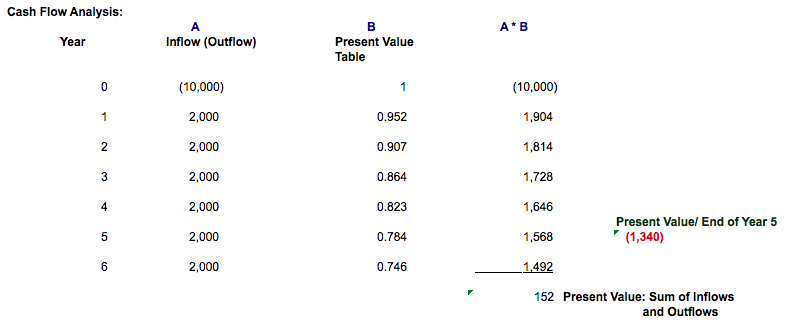

A business wants any investment to generate a positive net present value. This means that present value of the cash inflows and outflows is a positive number. Here is the sewing machine analysis:

This analysis states that $10,000 is paid in year zero, and that the six years of $2,000 annual cash inflows are discounted at 5%- the acceptable rate of return. The net present value (NPV) is $152, which means that the investment makes financial sense.

Note, however, that the NPV is a negative $1,340 after five years. It’s year six that moves the NPV into positive territory.

This type of analysis should be used to review each capital investment.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and finance:

https://www.accountingaccidentally.com/

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies