What Actor Mickey Rourke Teaches Us About Insider Trading (Blog Post, Graphics)

“Anytime you try a decent crime, you got 50 ways you can f*ck up. If you can think of 25 of them you’re a genius… and you ain’t no genius.”

This quote is from the movie Body Heat, a murder mystery from 1981. You’ll find a number of great actors in the movie. William Hurt is a defense attorney, and Mickey Rourke is a former client with a criminal record. The tables have turned, and Hurt’s character is asking the criminal to help him commit a crime. You’ll find the quote in this video link, about 1:50 into the clip.

Technology makes it easier to record and monitor data, and advances in IT happen constantly. The result? Committing a corporate crime, such as insider trading, becomes more difficult, because data can be analyzed instantly. In spite of this, people still attempt to profit from insider trading.

This post defines insider trading, provides a recent example, and explains how to set up controls to prevent insider trading.

Contents

Understanding what happened

In September of 2021, Compliance Week reported that: “The former chief compliance officer of Cavco Industries has been charged by the Securities and Exchange Commission (SEC) with internal accounting control failures and for misleading the Arizona-based manufactured home company’s auditor regarding an insider trading matter.”

Join Conference Room: An accounting, personal finance, and entrepreneurship community. Video, blog posts, live chats.

The article continues to explains that:

- Then-CEO Joseph Stegmayer, “used material, non-public information obtained through merger discussions with another public company, Skyline Corp., to trade in Skyline securities.”

- “When Skyline went on to merge with another company, its stock price jumped, “resulting in gains for Cavco of approximately $260,000 for the Skyline shares (he) had purchased based on material, non-public information.”

OK, it sounds like a problem, because the CEO used non-public information to profit, which put him at an advantage over people who didn’t have access to the same data.

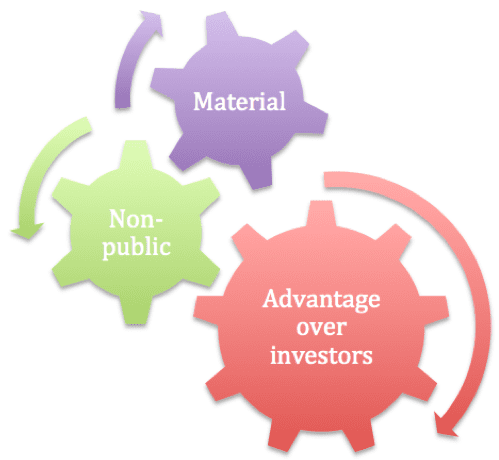

Defining insider trading

As Investopedia explains, insider trading occurs when an investor uses material, non-public information to gain an advantage over other investors.

- Material nonpublic information is any information that could substantially impact an investor’s decision to buy or sell the security that has not been made available to the public.

- The advantage could be a large gain on sale, or selling to prevent a loss.

- You do not have to be a company employee to commit insider trading. An employee, senior management person, broad member, outside accountant, or third party attorney: all can potentially benefit from using inside information.

Every well-managed business has controls in place to limit risk, including the risk of insider training. Cavco did have procedures in place, but the manager found a way around them.

Internal controls to control risks

Well, the good news is that Cavco had a policy in place regarding disclosure of stock trades:

“Daniel Urness was Cavco’s chief financial officer from 2005-18, in addition to serving as CCO from at least 2014 to August 2018… Cavco had an investment policy that required advanced disclosure of stock trading to its board of directors.”

There’s bad news, however. Urness, the CFO/COO was responsible for reviewing and approving any exceptions to the policy- and his trades were not reviewed by someone else.

The SEC complaint goes on to say that:

“Instead of fulfilling that duty, Urness circumvented the investment policy by setting up a system to fund the trades without informing the board or ensuring the trades complied with Cavco’s policies,” the SEC complaint stated.

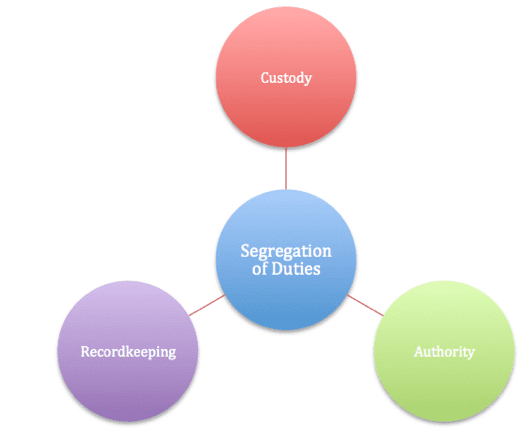

So, the fox was allowed to operate in the hen house, undetected. What could have preventing this situation? Proper segregation of duties.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting, personal finance, and entrepreneurship.

There are three duties that must be segregated (assigned to three different people), in order to minimize fraud or theft. Let’s use access to cash as example, since cash carries a high risk of theft:

- Custody: Who has physical custody of the checkbook? Assume the administrative assistant keeps the checkbook in a locked drawer.

- Authority: Who can sign a check? In other words, who has authority to move Let’s say only the owner can sign checks.

- Recordkeeping: Who reconciles the bank account? A timely bank reconciliation is often the best way to detect theft. The company’s accountant should reconcile the bank account within days of accessing the bank statement.

In this insider trading case, no one was reviewing the CFO’s trades. The CFO maintain too much control over the process, and the insider trading was not detected.

Next Steps

Review each of the tasks you complete in your business, and decide if you have any segregation of duties issues. Pay close attention to access to cash and fixed assets. If you find weaknesses, change your procedures to prevent fraud and theft.

Best of luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies