Understanding the Importance of Accounting in Business

Managing a business involves several things – from monitoring competitors to engaging the market to oversee the production process, hiring and training staff, and ensuring that taxes and all accounting reports are submitted on time. Accounting is one of the most important aspects of a business. Without it, a company can get into hot water with the Internal Revenue Service (IRS) and be subjected to penalties and audits.

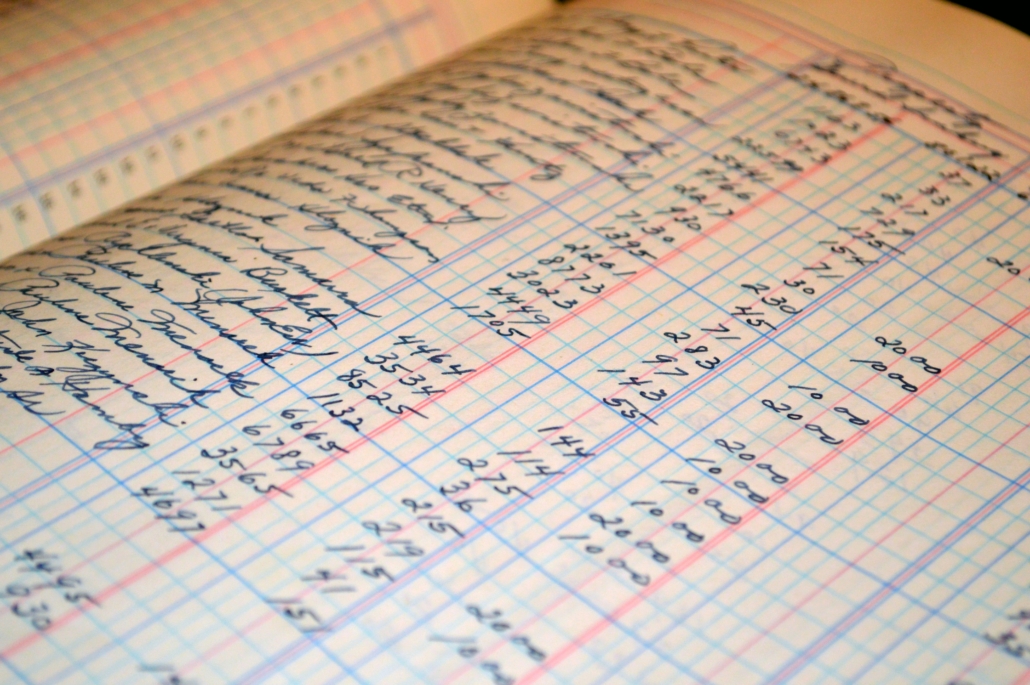

Accounting Explained

Accounting is a detailed and systematic process that involves the recording of an organization’s financial transactions. The work is performed by professionals who have a degree and working knowledge in accountancy. The process involves the analysis and the creation of a summary of a company’s financial transactions, including cash flows, profits gained, and expenses incurred. It also includes the creation and submission of reports to government agencies that regulate and collect taxes.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

What Accounting Does to a Business

Accounting is categorized into several types. Because of this, accountants may have different specializations, leading them to take different career paths. Some of the more known types of accounting are financial accounting, public accounting, government accounting, tax accounting, forensic accounting, management accounting, and internal auditing.

Importance of Accounting

Accounting is essential to any business, regardless of size. It provides the company several benefits, including the following:

Keeps Track of Cashflow

A healthy cash flow helps a business grow. It also helps business executives manage the business’s finances and hire new employees when needed. Managing cash flows, though, can be highly challenging, especially for novice small business owners. Even large corporations can have a hard time with cash flow management if they do not have their accounting staff.

Cash flow is the money that comes in and out of a company’s “register.” Knowing how much money goes in and out and why it is essential to keep track of a company’s health.

Helps Measure New Strategies

Business owners need to know whether their marketing strategies and other campaigns are effectively benefiting the enterprise. They need to conduct a risk analysis to determine whether the risks they took are helping the business or not.

With accounting, measuring the effectiveness of the strategies taken becomes easier. Since accounting records the movement of funds, it is easier for business owners to make comparisons and see what works and what needs to be improved.

Assists in Budgeting

Every business needs to have a set budget for operations. Future projections should also be made to carve the path for success. Accounting helps business owners to make the correct projections and create the proper budget for each plan they have for their ventures.

Ensures That the Business Comply with Regulations

The laws and regulations of every state can vary for each business. But, there is one thing that these have in common – the use of proper accounting systems and processes.

For instance, a company operating in cold supply chain management is bound to the rules of the Food Safety Modernization Act of 2011. Under this Act, supply chain businesses must maintain the cleanliness and functions of their equipment and follow transportation protocols.

Above all, they are required to keep records of all their transactions. The manner of keeping records of transactions is the same as all other types of business. They may differ in how they do business, but they follow the same accounting steps for reporting their transactions to the proper government bodies.

Helps to Detect Fraud

Fraud can happen in a business at any time. Customers, suppliers, and even employees may sometimes perform fraudulent acts that may hurt the company in some way. Thievery is rampant in many small businesses without the business owners knowing that they are being duped and robbed of their hard-earned money. With accounting, everything can be traced. Owners will have a way to see who spent the money or where the money went.

Guides in Decision-Making

There are common mistakes in business that make ventures fail. For instance, a business owner can overspend or underspend the finances meant for the business operations. It can be very easy to fall into these traps, but with proper accounting in place, owners can keep track of the amount they are allowed to spend to maintain the overall health of their companies.

Business owners can perform accounting by themselves. But sometimes, they may not be able to efficiently record every financial transaction because of the many other responsibilities they carry on their shoulders. For this, hiring a professional accountant is often the best choice. The accountant can perform every job related to the accounting aspect of the business and can help the company grow using its available assets.

Go to Accounting Accidentally for 400+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) https://www.accountingaccidentally.com/