4 Tips to Understand Consolidation Accounting (Video Link)

Whether you’re studying for the CPA exam, or taking an Advanced Accounting course, you may have trouble with accounting for consolidations.

Use these tips- and the video link- to understand the accounting process.

Contents

#1- What’s a Consolidation?

A consolidation means that two companies present their financials as if they are one company. Now, keep in mind that both firms continue to operate separately, and produce separate financial statements.

When a parent company buys all (or part) of a subsidiary, the consolidated financial statements reveal how the combined firms are performing financially. Did it make financial sense for the parent to buy the sub? The answer is in the consolidated financial statements.

#2- How is a Value Placed on the Subsidiary?

The value of the subsidiary (sub) is based on the purchase price paid by the parent, and the percentage of the total sub purchased.

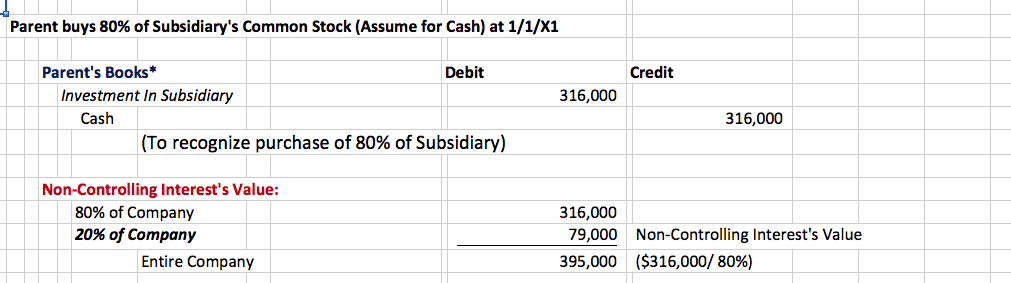

In this example, the parent pays $316,000 for 80% of the sub. The sub’s total value is ($316,000 / 80%), or $395,000. Another party, referred to as the non-controlling interest (NCI) owns the other 20%, or $79,000.

Note the screen shot below:

#3- Why Book Value is Important

When a parent buys a sub, the parent is buying the book value (assets less liabilities) of the sub. That’s the true value of the sub that is purchased.

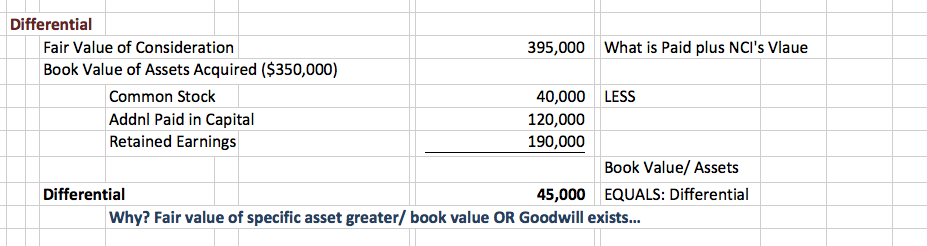

The difference between the fair value of the consideration paid ($395,000) and the book value ($350,000 in this case) is the differential.

Check out this screenshot:

#4- How to Account for the Differential

It’s not unusual to pay more for an asset you really want. In fact, you might pay more than the fair market value of an asset, if you thought the purchase would pay off for you down the road.

People pay more than fair value (market value) for houses, cars, and other assets.

The same is true with business purchases. So how does the accounting work?

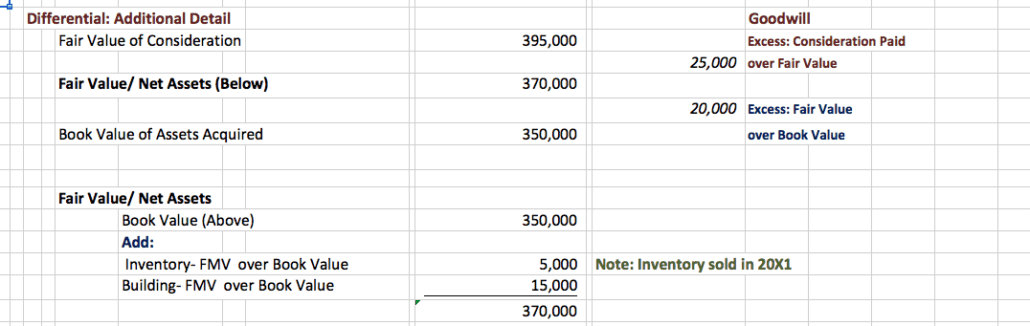

This example assume that two assets have a fair market value greater than book value, and fair market value of the subs net assets (assets less liabilities) is $370,000.

The difference between book value and fair value ($20,000) is accounted for by increasing the value of the assets to fair market value in consolidation. In other words, the assets you see in a consolidated balance sheet are presented at fair market value.

What about the excess paid above fair market value?

In this example, that excess is $395,000 (consideration paid) less $370,000 (fair value) the $25,000 is allocated to a new asset account, goodwill. The goodwill balance is amortized (expensed) over a period of years.

Here’s the video that explains these concepts:

For live CPA exam prep and accounting classes, join Conference Room for free. Members will be notified of course dates, times, costs, and how to attend these courses.

Get your questions answered to pass the CPA exam, and to learn accounting concepts.

Go to Accounting Accidentally for 300+ blog posts and 450+ You Tube videos on accounting and finance.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) https://www.accountingaccidentally.com/