Accounting for Statement of Cash Flows (2 Video Links)

If you’ve taking an intermediate accounting class, or studying for the CPA exam, you may struggle with the statement of cash flows.

You’re not alone.

This discussion explains these concepts using screenshots from spreadsheets. Links to the You Tube videos that explain the topics are here and here.

Contents

Where did you cash go?

Cash does not equal profit.

Image that you start a business in January, and contribute $40,000 in cash into the firm. You’re profitable each month, but you notice that your cash balance is only $28,000 on June 1st.

How can you have less cash than where you started?

The answer is in the statement of cash flows, which separates cash transactions into three sections.

Three categories

If you review all of your cash inflows and outflows, the transactions can be separated into three categories:

- Cash flows from operations: These are cash flows related to the day-to-day activities of running your business. Paying suppliers, processing payroll, and depositing customer payments are posted to operations. In fact, most of your business activity will end up here.

- Cash flows from investing: You need assets to operate your business. Investing refers to buying and selling company assets. Buying a machine is a cash outflow, and selling a piece of equipment is a cash inflow.

- Cash flows from financing: This category includes raising money to run your business and paying it back. Issuing a bond is a cash inflow, while paying a dividend to shareholders is a cash outflow.

Here’s the formula for the ending balance in cash:

- Beginning balance in cash, plus

- Net effect of the inflows and outflows, equals

- Ending cash balance.

The ending balance in cash should agree to the cash balance in the balance sheet.

Figuring out cash flows for financing and investing is straightforward. The more difficult concept is using the indirect method to compute cash flows from operations.

Indirect method, cash flows from operations

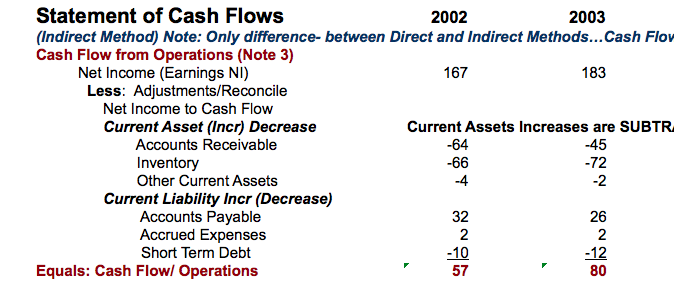

The indirect method requires you to reconcile from company net income to cash flow from operations. Here’s a screenshot from my video that illustrates the process:

The 2002 indirect method starts with $167 in net income and reconciles down to cash flow from operations of $57.

Now, here’s the tough part.

You see that adjustments are made to current assets and current liabilities.

- An increase in current assets is subtracted in the reconciliation. In 2002, a $64 increase in accounts receivable is subtracted.

- An increase in current liabilities is added in the reconciliation. For 2002, a $32 increase in account payable is added.

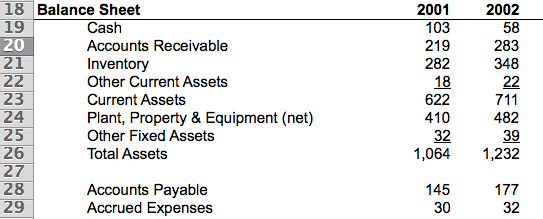

These changes come from the balance sheets for ’02 and ’03, which are also in the spreadsheet:

Accounts receivable increased from 219 to 283 ($64), and accounts payable increased from $145 to $177 ($32).

The best way to learn this concept is to link two balance sheets to the cash flow statement, which is what the spreadsheet (and the videos) present.

Investing and financing cash flow are easier to understand.

Working with Investing and Financing

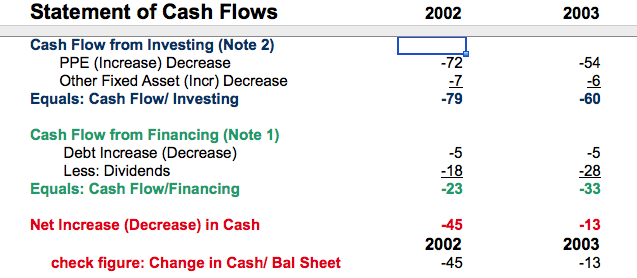

Take a look at the rest of the cash flow statement:

In the investing category, the property, plant and equipment account increased by $72. The company bought assets, so cash decreased.

If you look at the financing section, note that the firm paid back $5 in debt, which is also a cash use.

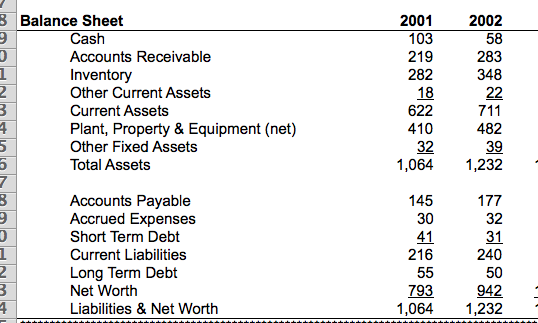

Again, let’s go back to the balance sheet detail:

Property, plant and equipment increased by $410 to $482 (a $72 increase). Long-term debt, on the other hand, decreased from $55 to $50.

One more thing.

The net change in cash is $45. If you check the cash balances in the balance sheet, you’ll see that cash declined from $103 to $58, a $45 decrease.

My next book, 25 Intermediate Accounting Spreadsheets (and How to Use Them) will be out in January of 2020. The format will include a written discussion of a spreadsheet, with spreadsheet images, and a related video.

To learn more and get sample chapters of the book, watch this video.

For live CPA exam prep and accounting classes, join Conference Room for free. Members will be notified of course dates, times, costs, and how to attend these courses.

Get your questions answered to pass the CPA exam, and to learn accounting concepts.

Go to Accounting Accidentally for 300+ blog posts and 450+ You Tube videos on accounting and finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) https://www.accountingaccidentally.com/