5 Tips to Understand Pension Accounting (2 Video Links)

What, exactly, is a pension, and how does the accounting work?

Both CPA exam candidates and undergraduate accounting students struggle with this concept, so I thought I’d explain the basic concepts here.

Contents

Pension- Defined

A corporate pension is a written agreement that requires a business to pay a former employee a series of payments at retirement. Everyone is familiar with pensions, either through your own job, or the pension offered by a friend or relative’s company.

The tricky part is who is liable to pay the pension, and how the liability is calculated.

Two Types of Plans

The CPA exam, and intermediate accounting courses, will test you on the two types of pensions:

Defined benefit

This plan requires the business to pay a specific sum to a retiree each month, and the payment amount is based on several factors. Defined benefit plans consider years of service, and the worker’s salary for the last year of work (or the last few years of work).

The company is on the hook to pay a specific dollar amount- regardless of the dollars invested in the plan, and the rate of return earned on those dollars. So, if the money in the plan isn’t sufficient to make the payments, the company makes up the difference.

In the US, companies are shifting the liability for the pension payment amount to the retiree by switching to defined contribution plans.

Defined contribution

In this type of plan, the company is liable for contributing a specific dollar amount into the pension plan- but not for a specific pension payment. The investment performance of the dollars in the plan determines the pension benefit paid, which shifts the burden away from the employer.

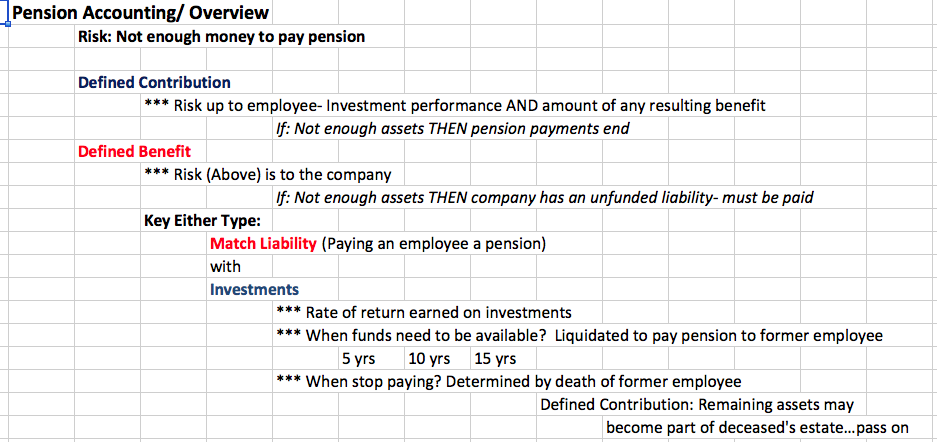

Here’s a screenshot from my Pension part one video, which you can access here:

The Bucket Analogy

The CPA exam and intermediate accounting tests spend more time covering defined benefit plans, since the accounting is more complicated. Many of these questions ask: How is the company’s pension liability calculated?

To answer the question, think of the pension plan as a bucket. Dollars are invested into the plan, and those dollars earn a rate of return. Those transactions fill the bucket.

So, what comes out of the bucket? The costs incurred to manage the plan, and payments to retirees.

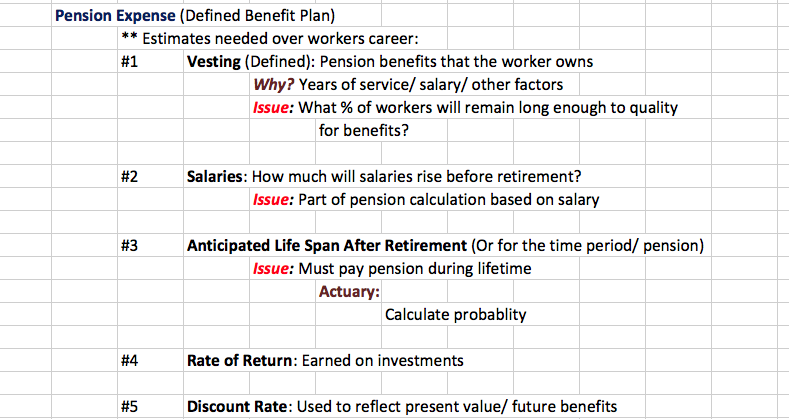

This screenshot from the Pension part two video explains more, and you can access the video here:

For live CPA exam prep and accounting classes, join Conference Room for free:

Members will be notified of course dates, times, costs, and how to attend these courses. Get your questions answered to pass the CPA exam, and to learn accounting concepts.

Go to Accounting Accidentally for 300+ blog posts and 400+ You Tube videos on accounting and finance.

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) https://www.accountingaccidentally.com/