Business Costs Increasing? Accounting Tools to Maintain Profitability

It’s June of 2021, and business costs are increasing in a number of industries. Manufacturers are paying more for raw materials, computer chips are in short supply, and restaurants are struggling to find enough staff. There are several factors that may hurt your bottom line:

- As we come out of the pandemic, consumers are spending money, and business owners want to meet customer demand.

- Your costs may increase before you can pass along a price increase

- If you operate in a highly competitive environment, you may not be able to increase prices and maintain your market share

But how can you maintain profitability in an environment of rising costs? Here are some accounting tools to make better decisions, and to maintain profitability.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

Contents

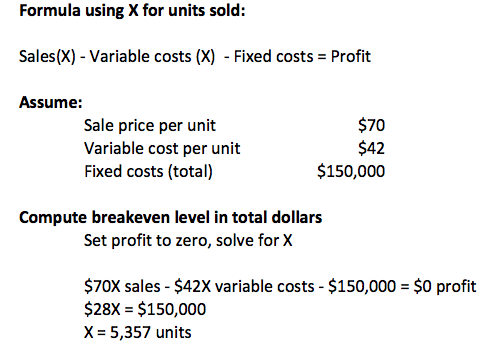

Start with the breakeven formula

The first rule of thumb is to cover all of your costs, and the breakeven formula is the tool to assess that issue. As you see below, the formula sets profit (net income) to zero and solves for the number of units sold. Keep these points in mind:

- Both sale price per unit and variable costs per unit are multiplied by the number of units sold (X)

- Use total fixed dollars, not fixed dollars per unit. Eventually, all fixed costs are paid for, and you don’t need to assign a per unit amount for fixed costs. Stick with total dollar amount

- The formula calculates the number of units sold needed to reach breakeven

The business must sell 5,537 units to breakeven.

With if circumstances change? No problem, you can change the formula.

Changing assumptions in the breakeven formula

If your variable costs increase, you can change variable costs per unit in the formula and run the calculation again. Let’s assume that variable costs increase to $50 per unit. Here’s the new breakeven level:

$70X sales – $50X variable costs – $150,000 = $0 profit

$20X = $150,000

X = 7,500 units

An $8 increase in variable costs ($42 to $50), requires the business to sell 2,143 more units to reach breakeven.

That’s how you should think of cost increases: how many more units do I need to sell, in order to breakeven?

You can change the formula and make assumptions about profits.

Considering target net income

Let’s assume that the owner wants to generate a $50,000 profit, which is referred to as the target net income. Here’s how the formula looks with the profit included:

$70X sales – $50 X variable costs – $150,000 = $50,000 profit

$20X = $200,000

X = 10,000 units

You can perform “what-if” analysis on any factor in the formula, and run the numbers to see where you stand.

If your costs are increasing, how can you maintain profits?

Strategies to maintain profits

To keep your business profitable, you should evaluate your business from both a cost point of view, and a pricing point of view.

Minimizing costs

The rise in inflation and product shortages may lead to price increases, some of which are unavoidable. Here are some ideas to lessen the impact of higher costs:

- Find more vendors: Find more reputable vendors who can sell you products. If you have multiple vendors, you may be able to negotiate lower prices.

- Adjust your spending: Do you really need to buy as much of a particular item as you do now? Can you substitute certain materials or components for a cheaper option?

Don’t forget to think about pricing.

Increasing prices

Over 35 years in business, I’ve noticed that successful companies are more comfortable increasing prices.

If you’re hesitant, think about this way: If your car mechanic, plumber, or grocery store raised prices, would you still buy their products and services? If the answer is yes, it’s because you believe that they offer enough value to justify the increase.

We’re all consumers, and we’re not surprised by price increases- particularly in today’s environment. If you offer value, most of your customers will accept a price increase. Those that don’t aren’t a reliable source of business.

Good luck!

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and personal finance:

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net