5 Timeless Ways to Protect Yourself from Money Issues (Blog post, graphics)

Are you feeling like the world is crumbling down around you? Do money problems seem like they’re too much to manage? Don’t panic. Money might never be easy to deal with, but it doesn’t mean that life should be hard or that there’s no hope for peace.

The key to surviving today’s money issues is taking care of your finances before things get out of hand. Here are five timeless ways to protect yourself from the stress and pressure of money issues.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

Contents

Have a Financial Plan

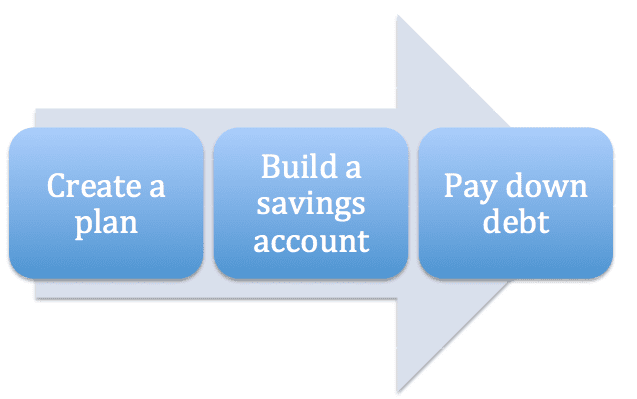

Many young adults today fail to understand the concept of having a financial plan. Research shows that more than 50 percent of college grads have no financial plan in place for after they graduate. The best way to protect yourself from money problems is by making a plan and sticking to it.

By creating a financial plan, you’ll be able to estimate how much money you’ll need to meet your budget. You can keep track of your progress every month and use the information to adjust your plan when needed. Once you find a financial plan that is realistic and easy for you to maintain, it will be much easier for you to avoid money problems in the future.

Save for Retirement AS YOU EARN

Many people don’t realize how much money they need to save for retirement. It’s never too early to start planning for retirement, and that’s why many financial experts recommend that you start saving in your mid-20s.

“But I’m still paying off debt,” you might wonder. The good news is that this is fine. Saving while you’re paying off debt will help you avoid debt, which will also protect you from money problems in the future.

“But I don’t make enough to save,” you might say. The good news here is that there are ways to earn more money without taking on more debt.

For example, switching careers to a higher-paying job can help you earn more money while still paying off debt. Or, look for side hustles to make money while you’re not working. There are tons of ways to be more productive with less time, which can help you get ahead financially.

Pay off Debt

Yes, paying off debt will help you avoid money problems, but it’s also a great way to become financially independent. One of the easiest mistakes to make is spending money on what’s available without considering the future.

For example, trying to buy as much as you can now instead of saving your money for retirement. You may want to get a TV streaming subscription such as peacock, but is peacock worth it?

While it’s understandable that you want what you want and when you want it, this thinking is why people end up in debt. Plus, it’s essential to think about what you can afford now versus what you think you might want in the future.

When you’re deep in debt, it can be easy to feel like things will never change. However, the sooner you get out of debt, the sooner you will solve your money problems. Paying down your debt will not only help you become financially independent; it will also help lower your stress levels and give you more energy for the rest of your life.

Keep an Emergency Fund

Financial experts agree that having at least six months’ worth of living expenses is essential to prepare for any emergency. The easiest way to prepare for an emergency is by setting aside money each month to put into a separate account for emergencies.

If there are any types of unexpected expenses, or if you lose your job, you’ll have plenty of money saved to last through the tough times.

Invest Each Month

One of the most innovative ways to grow your wealth is by investing your money. Big companies like the NRIA have been focusing on real estate for their investment, and this creates opportunities for wealth and investment if you want to buy into real estate. It’s one of the best investments that you could make, in fact, given that real estate is a tangible asset that is more secure than most.

Earning money while you relax is key to financial success, and it is by investing, you can reach this goal. Once you make your savings work for you, your money will eventually pay off your debt or finance businesses that can help you earn more money. By investing, you can avoid stagnating and live a life of great financial freedom.

Next Steps

Money issues are a genuine concern for many people. They can be a sign that something is going wrong in your financial life.

If you want to protect yourself from money issues for the rest of your life, learn how to manage your money properly. Start by thinking about your long-term goals and how to reach them. Once you establish a relationship between your current finances and your goals, you will succeed in all life areas.

And remember, we all need to work on our money issues somehow, but sometimes it’s better to learn from others than from experience alone. So, make sure to take the time to pay attention and keep learning. Don’t forget that the most challenging part about learning practical ways to manage your finances is that it can feel awful at first.

Consult with a financial advisor and a CPA regarding personal finance issues.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) https://www.accountingaccidentally.com/